Specialist anaesthesia services attract a fee separate to those charged by the hospital, surgeon or other doctors caring for you. While the fee will vary depending on the complexity and duration of the anaesthesia, it is usually possible to obtain an estimate ahead of surgery.

Our estimates and billing services are provided by ProBills Australia (PBA) who are extremely efficient and responsive (for further information on fees and billing see contact details at www.probills.com.au).

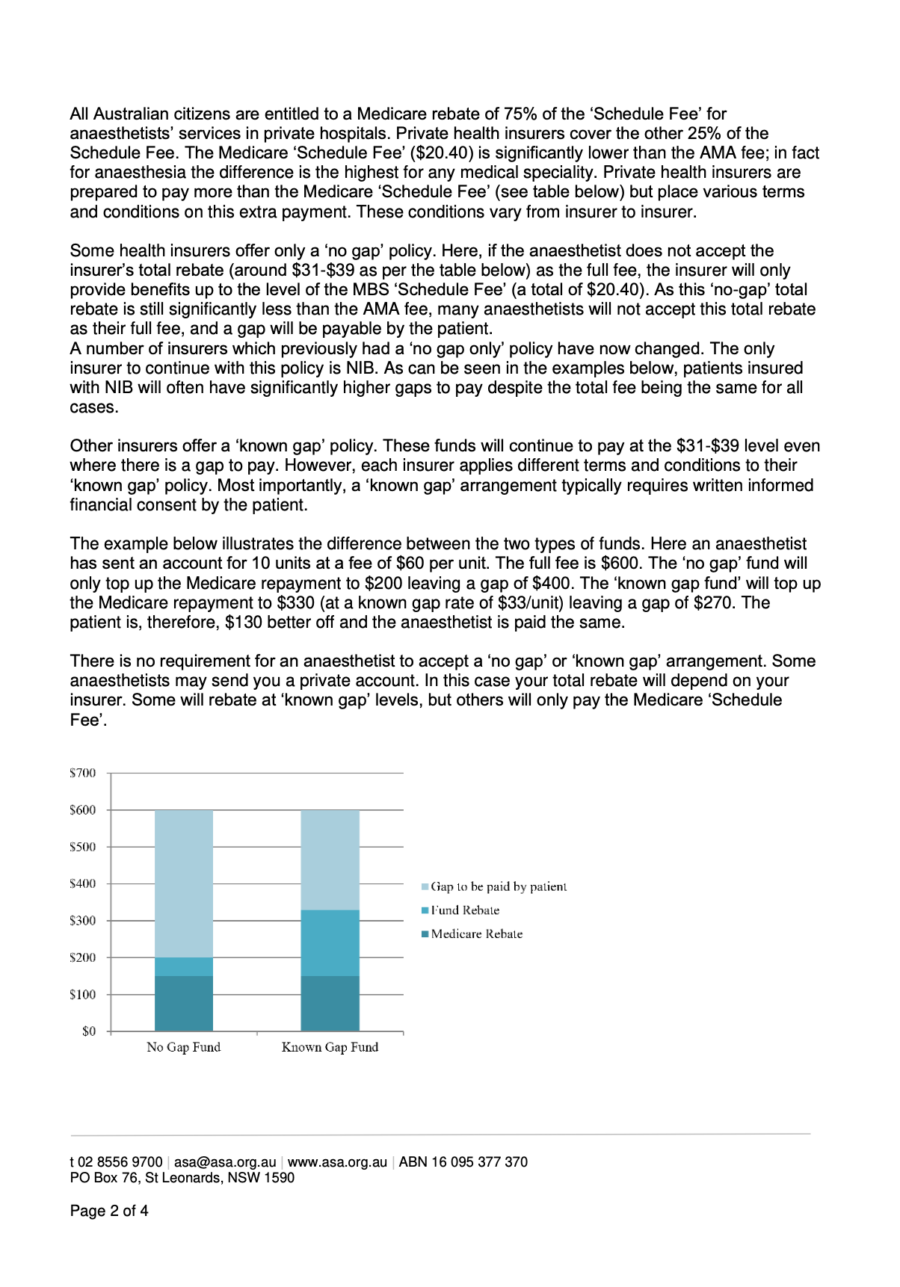

You may be able to claim a rebate for a portion of your anaesthetic fee from Medicare and your private health insurance fund. Often there is an associated out-of-pocket expense and the size of this ‘gap’ varies depending on your fund and your level of coverage.

Operating lists are available a week or so ahead of each operating day and that list is used to provide fee estimates to patients prior to surgery. If you have not received an estimate please complete a fee estimate request at www.probills.com.au/fee-estimate/

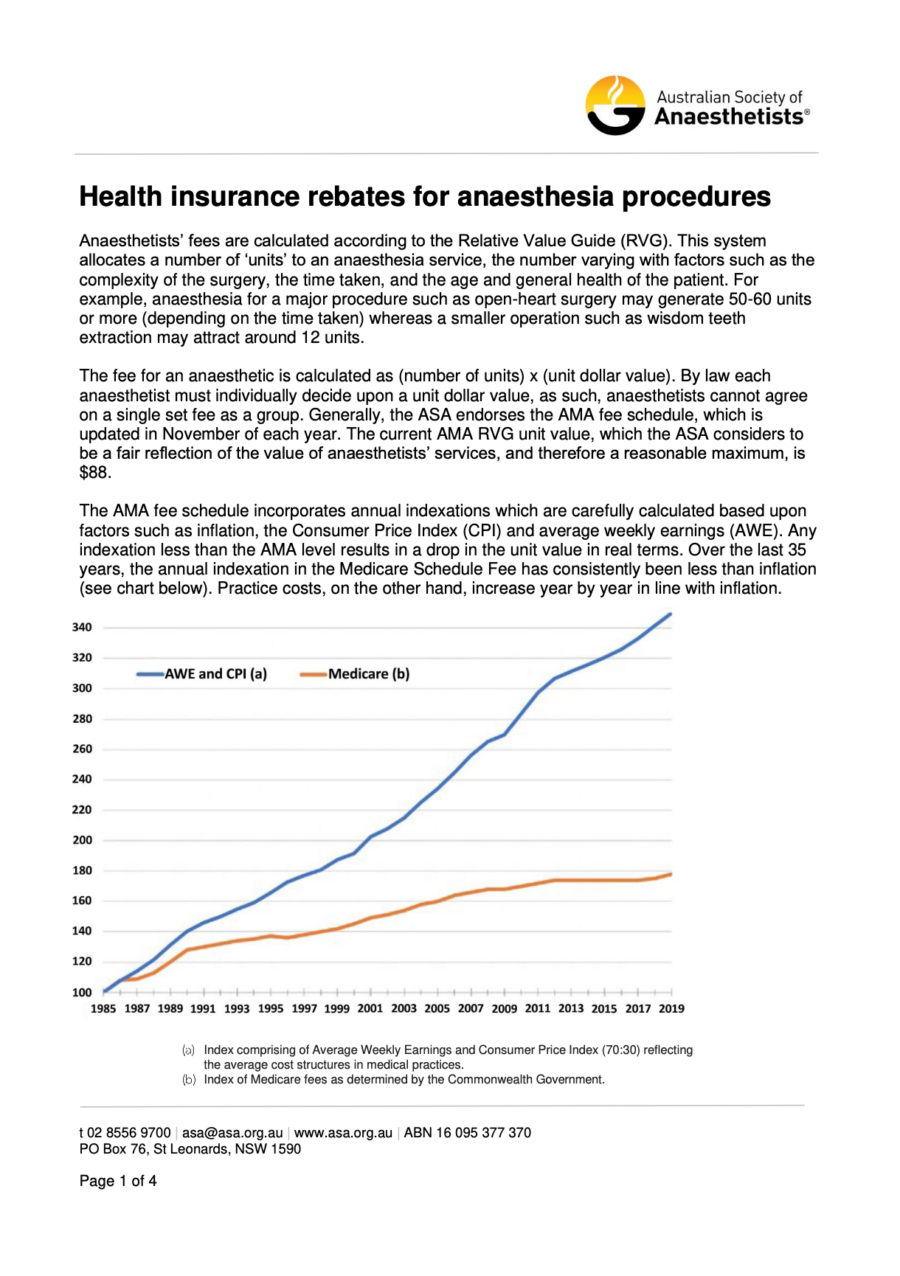

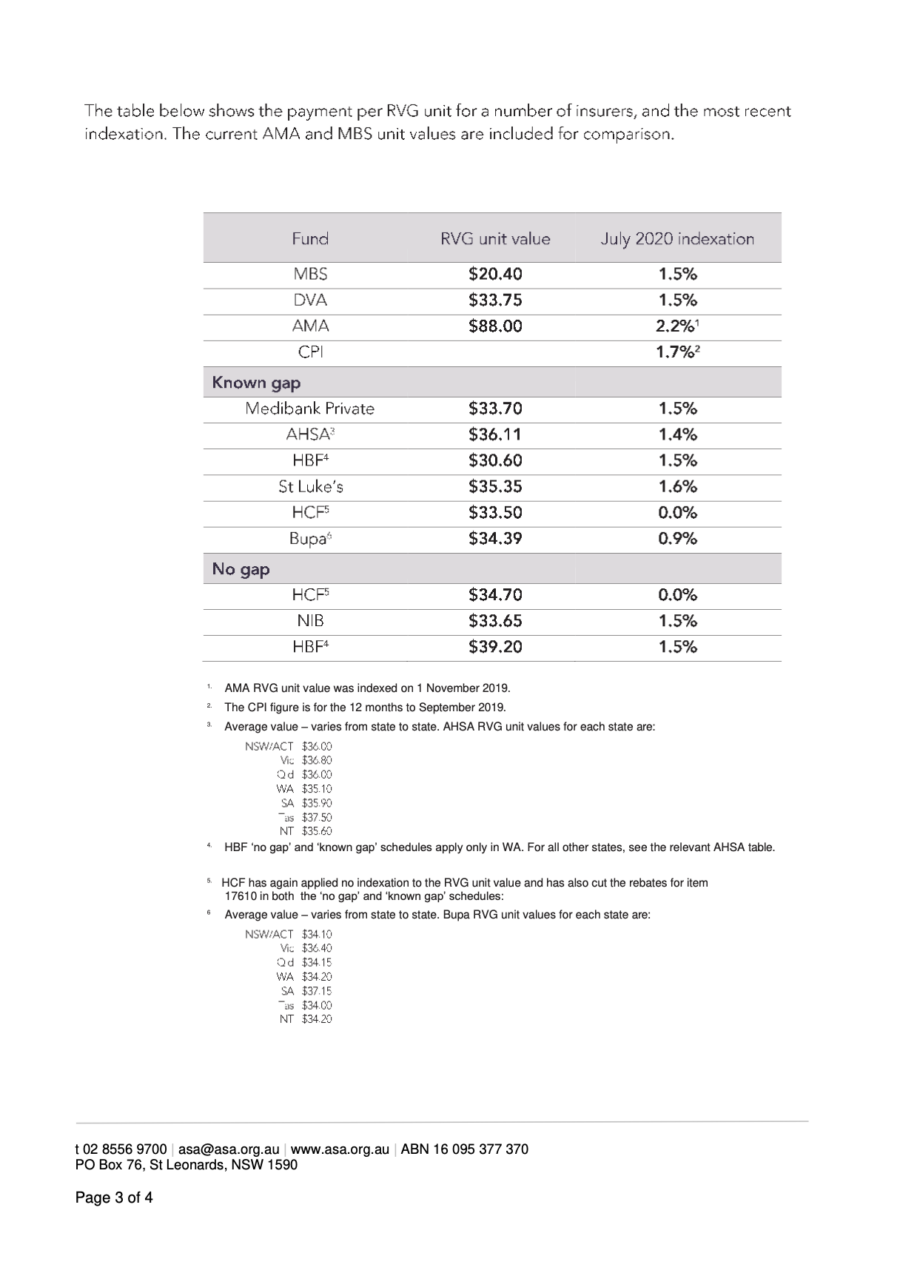

My fees are derived using the Australian Society of Anaesthetists’ Relative Value Guide. They are less than those recommended by the Australian Medical Association. The fees are based on the complexity, duration and time of day of the service. Due to inadequate indexation over decades, the rebates provided by Medicare and the health funds will usually be less than the fee, resulting in an out-of-pocket expense. I do not alter the fee depending on which insurance company the patient uses. The out-of-pocket cost, therefore, depends on the insurance company shortfall.

I always endeavour to keep costs in line with, or below, estimates.

WHY THE GAP?

Medicare and health fund rebates have not kept pace with the compliance costs of running an anaesthesia practice nor with wage or CPI indexation. More on this subject is available here